You may also want to bank with Chase if you like to keep your many bank accounts in one place. For example, you could open a simple savings account for yourself, a CD to save toward a new car and a checking account for your college student complete with debit card. You should be prepared to pay monthly maintenance fees for any Chase account you own.

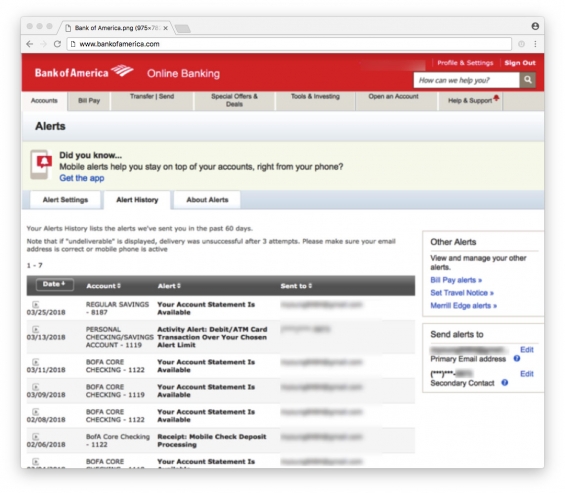

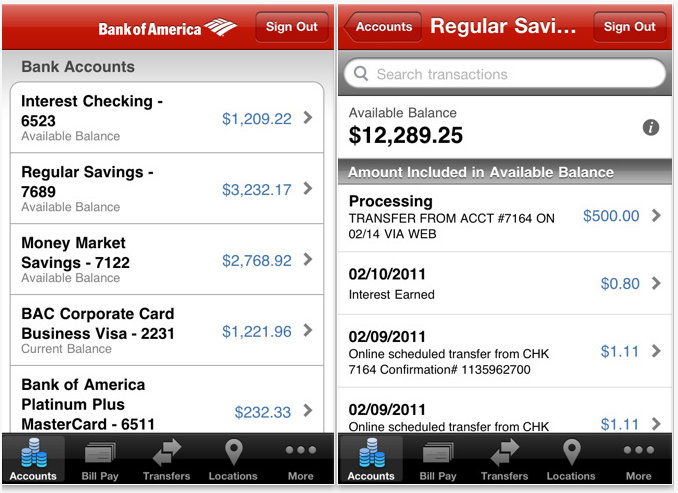

There are often a number of ways to have these fees waived, however, whether you need to maintain a balance minimum or complete certain transactions monthly. If you don't need the assistance of a customer service representative, you can easily manage and access your money online or on the bank's mobile app. You can deposit checks on the app by taking a picture of both sides of the check. You can transfer money, pay bills, locate ATMs and branches and receive customized alerts on your mobile app, as well. You can see your checking account balances, your transactions and other balances.

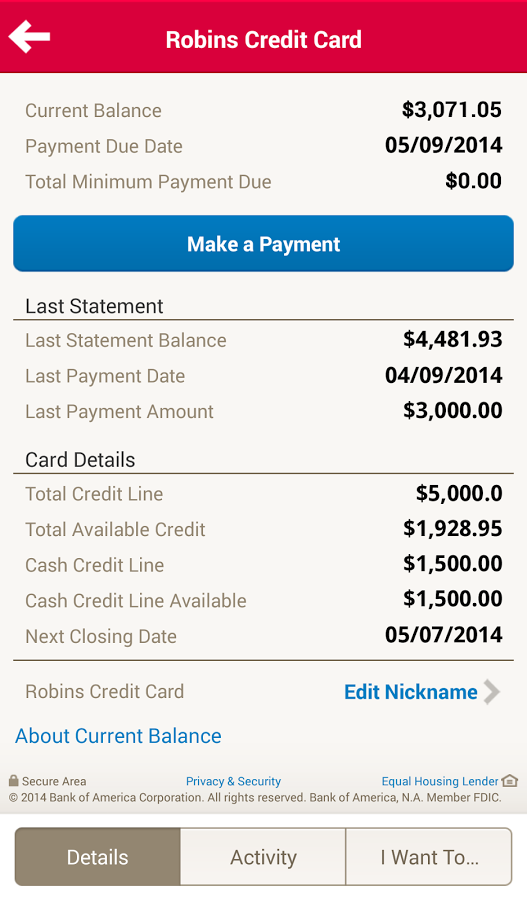

All three checking accounts do offer some ease in saving through two programs. The Keep the Change® program links your checking account to your savings account. When you make purchases with your debit card, Bank of America will round that purchase up to the nearest dollar. You also have access to BankAmeriDeals® which provides cash back deals. When you pay for purchases with your debit or credit card you can earn cash back that is debited to your account by the end of the following month. You can access both of these programs through Online and Mobile Banking.

However, you do not have to attend one of the affiliated schools to open a U.S. And there are several appealing reasons to do so, starting with the $0 monthly maintenance fee it offers and the U.S. You also get the ATM fee waived for your first four non-U.S. Bank ATM transactions per statement period, and your first order of checks is free.

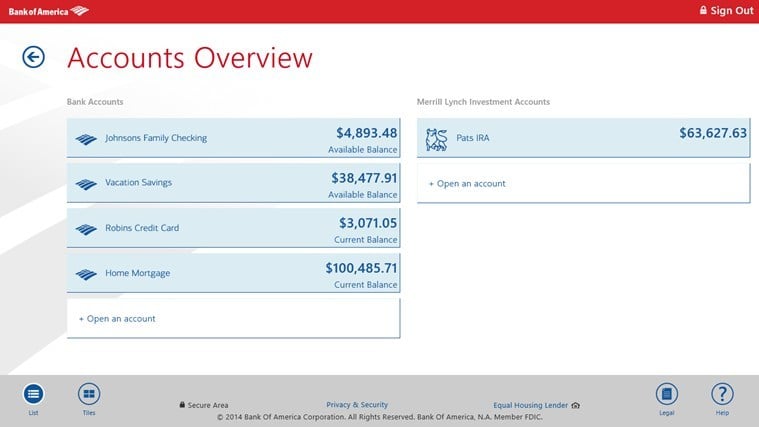

Both big banks offer a variety of bank accounts, allowing customers to benefit from the convenience of having a full suite with one company. You can open two kinds of savings accounts with Chase – the Chase Savings and Chase Premier Savings accounts – while Bank of America currently offers just one savings account. Bank of America also falls slightly behind in its checking account offerings with three options while Chase offers five options, including two student checking accounts. Plus, two Chase checking accounts earn interest while only one Bank of America checking account earns interest. Bank of America does offer a Featured CD in addition to its Standard Term CD accounts.

Just snap photos of the front and back of your check, enter the deposit amount, choose an account, and submit your deposit.|| It's never been easier—or safer—to bank from the comfort of your phone. With UMB Bank, personal banking is made easy with a suite of services from checking and savings accounts to credit services, investing and wealth management. We help you manage your money, meet your financial goals and finance your next big purchase. Our personal checking accounts and savings accounts are designed with your needs in mind, and we offer credit card and personal lending products with competitive rates. The bank does offer an opportunity to snag deals and save money with its BankAmeriDeals® program.

It provides cash back deals when you pay for purchases with your debit or credit card. The cash back is then debited to your account by the end of the following month. Plus, your mobile app shows you exactly where you can earn these rewards with an interactive map tool.

You can also access the program through your online account. The bank's checking account earns 1% cash back on up to $3,000 of qualifying debit card purchases each month. The savings account pays a competitive rate and Discover offers a suite of other products and services.

SafeBalance Banking is the lowest tier, which means it comes with the least features. For example, while account holders will be able to take advantage of a free debit card and Zelle® money transfers, paper checks and overdraft protection are not included. However, because this account is fairly basic, it comes with the lowest monthly maintenance fee, which is $4.95.

This fee can be waived if you're enrolled in BoA's Preferred Rewards program or you're a student under the age of 24 that's currently enrolled in school. Bank5 Connect offers a checking account, savings account and CDs with terms from six months to 36 months. The mobile app gets 5 stars out of 5 on the App Store and 4.3 out of 5 stars on Google Play .

Rates at BankFive may be higher or lower than rates at Bank5 Connect, depending on the product you choose. All of the accounts included on this list are FDIC-insured up to $250,000. Note that the interest rates and fee structures for brick-and-mortar savings accounts are subject to change without notice. Product and feature availability vary by market so they may not be offered depending on where you live. Most brick-and-mortar banks require you to enter your zip code online for the correct account offerings. Any return on your savings depends on the associated fees and the balance you have in your brick-and-mortar savings account.

To open a savings account, most banks and institutions require a deposit of new money, meaning you can't transfer money you already had in an account at that bank. We also considered factors such as insurance policies, users' deposit options, other savings accounts being offered by the same bank and customer reviews when available. Student bank accounts offer a low-fee option for high school and college students. The lack of monthly fees, the low minimum deposit requirements, and the offers to waive specific fees all help new account-holders learn the ropes of money management inexpensively. Having a student bank account allows students to keep their focus on their classes rather than jumping through banking hoops to keep their money safe. The Plus Banking tier of this BoA program includes everything SafeBalance Banking does, only it adds in paper check availability and overdraft protection.

Again, this is not an interest-bearing account, and a minimum initial deposit of $100 is required to open it. The monthly maintenance fee for this account is also higher, as it starts at $12. The qualifying balance is calculated based on your average daily balance for a three calendar month period. Refer to your Personal Schedule of Fees for details on accounts that qualify towards the combined balance calculation and receive program benefits.

Eligibility to enroll is generally available three or more business days after the end of the calendar month in which you satisfy the requirements. Benefits become effective within 30 days of your enrollment, or for new accounts within 30 days of account opening, unless we indicate otherwise. Certain benefits are also available without enrolling in Preferred Rewards if you satisfy balance and other requirements. For details on employee qualification requirements, please visit the Employee Financial Services intranet site. The Advantage Plus checking account offered by Bank of America offers standard features.

You'll have the option to pay for purchases with a debit card, Zelle, mobile and online banking or paper checks. Lastly, the Relationship Banking tier is the only BoA checking account that earns interest. However, the account's rates are quite low, as all balances less than $50,000 receive just a 0.01% APY and all balances of $50,000 and up receive an equally unimpressive 0.02% APY. Otherwise, this account also calls for a $100 minimum opening deposit, and its features are the same as the Plus Banking tier. The monthly fee is much higher than the aforementioned mid-tier account, though, as it starts at $25 per month. To waive this charge, you can enroll in the Preferred Rewards program or maintain a combined balance of $10,000 across all of your eligible linked accounts.

Generally, Bank5 Connect offers a winning combination of attractive rates and low minimum deposit requirements across its products. It requires only $10 to open a savings or checking account and a relatively easy-to-meet $500 minimum deposit requirement to open a CD. There are no monthly maintenance fees on any of its accounts.

Quontic Bank offers one savings account, three checking accounts, a money market account and five CDs with terms ranging from six months to five years. Quontic recently launched its Bitcoin Rewards Checking account, only available in select states so far. The mobile app gets 4.5 stars out of 5 on the App Store and 3.4 stars out of 5 on Google Play. Quontic offers competitive APYs across its other products, along with low minimum deposit requirements and access to 90,000+ surcharge-free ATMs throughout the U.S.

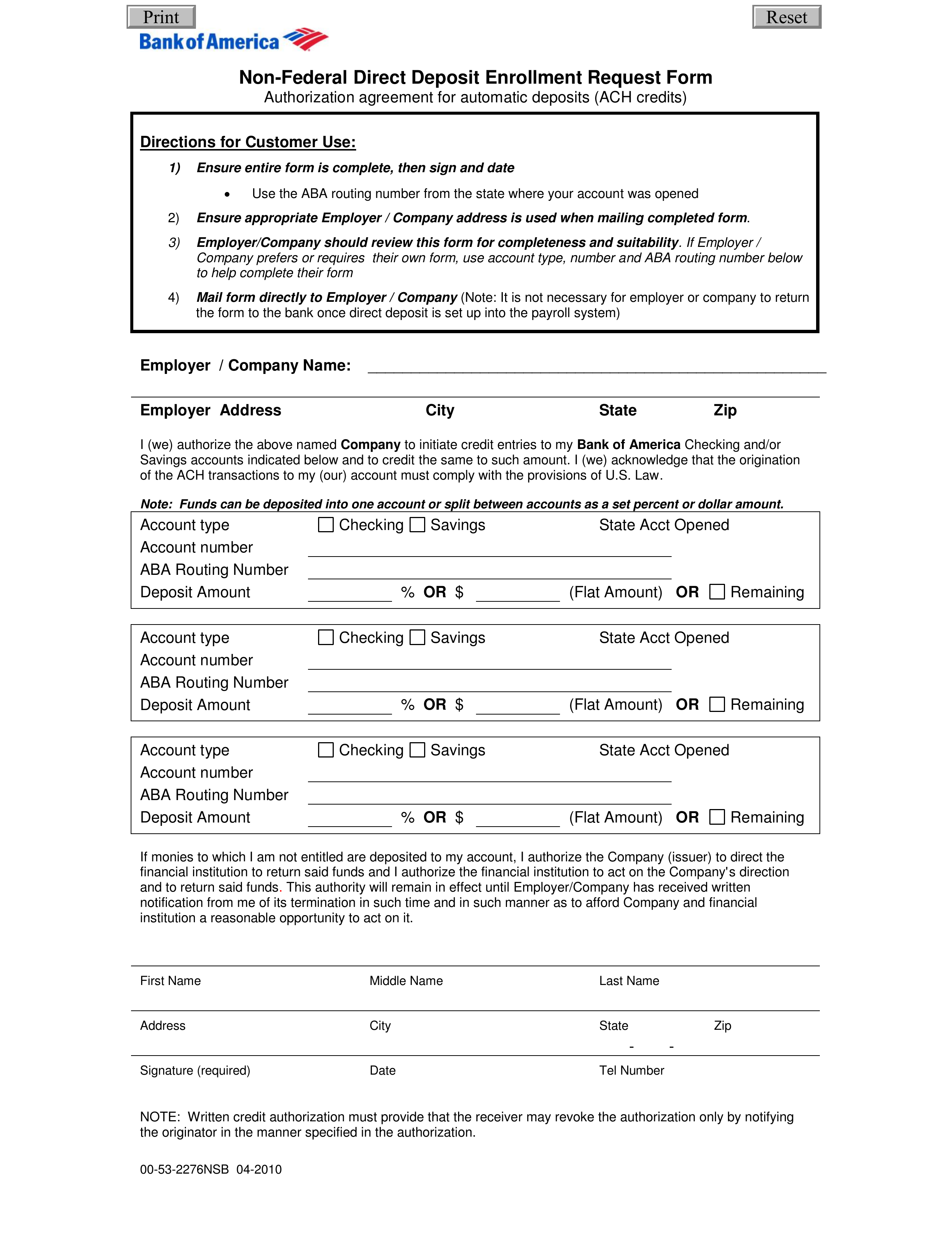

Quontic customers get all the features you may expect from a digital bank, including 24/7 access to online banking and a highly rated mobile app. This bank has no monthly fees or minimum balance requirements for its checking or savings products. Customers have access to an extensive ATM network and automatic savings tools. You may even receive your paycheck up to two days early with direct deposit. You can receive monthly direct deposits of at least $250 or maintain a minimum daily account balance of at least $1,500, among other options. If you need to transfer money from another bank to your Bank of America account, log into your online banking through that bank's website and look for a bank-to-bank transfer option.

You'll need your Bank of America account and routing numbers. Generally, you'll need to go through a verification process to confirm you're the owner of the receiving account before you can request the transfer. It can take three to five business days for the funds to appear in your account, depending on the bank. There are few different ways you can transfer money to a Bank of America account. To transfer money instantly from another Bank of America account, you can use the ATM or move funds online. For transfers from another bank, you'll need to transfer funds through the other bank's online banking system or complete a wire transfer.

You can also use a credit card to transfer money into your account. The fees vary from free to about $40, depending on the transfer method. The Bank of America Advantage Savings account requires a $100 opening deposit, which is on the higher end for brick-and-mortar savings accounts. There is an $8-per-month maintenance fee that is waived for the first six months for new account holders.

This is a perk not offered often, so something to consider if you are low on cash in the first few months of opening the account. While other big banks offer options to waive their monthly fees, none automatically waive it for new account holders as they start out. Monthly fees can range from $4 to $25, depending on the bank.

The bank also offers a variety of bank accounts from a simple savings account to three checking accounts and four IRAs. Again, you'll want to pay attention to each account's monthly fee. You can often have these fees waived by meeting certain minimums or completing certain transactions. Altabank's mobile banking services use the same high security standards as our personal and business online banking services. Mobile banking uses 128-bit SSL encryption to protect your information, and we don't store any information on your phone. You are required to log in each time you access your account information or bill pay services through mobile banking.

Mobile banking is available to existing online banking users only. All terms applicable to online banking apply to mobile banking. While the Discover Cashback Debit Account isn't specifically created for students, it's an excellent option for anyone 18 or older who wants all the perks of a student account, plus a debit card.

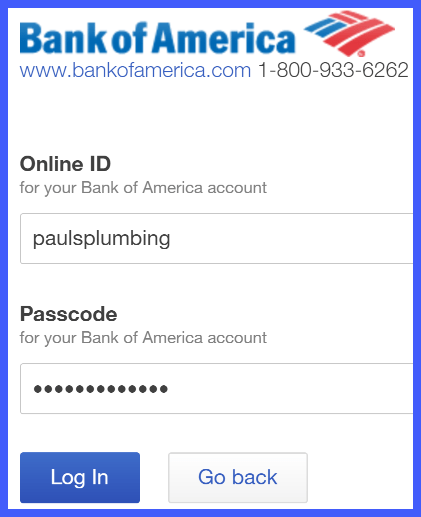

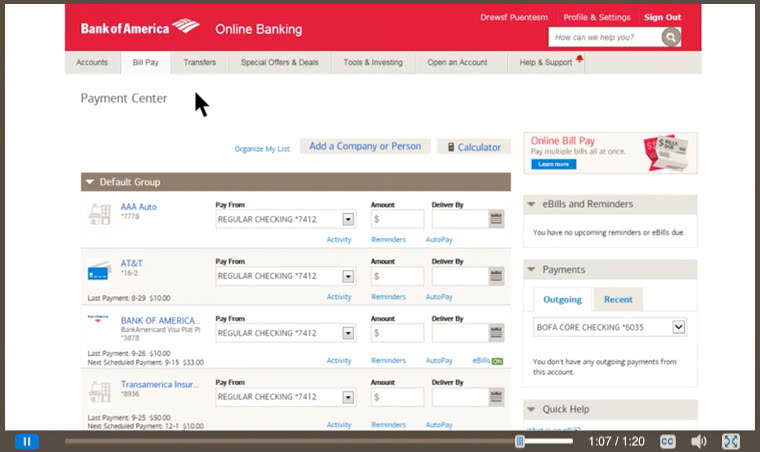

This account has no monthly fee, minimum deposit, overdraft fee, or ATM fee, all of which you can continue to enjoy even after leaving school. Another big draw is the 1% cash back that you can earn on up to $3,000 in monthly debit card purchases, which generates up to $360 in cash back per year. When you own a business, you don't always have time to visit the bank. With Bank of America's online banking, you can view your checking and savings accounts, see past statements and use the Bill Pay feature. You can view personal and business accounts using a single login with the online system. To sign in to your account, you first need to sign up for online banking.

Bank of America will then prompt you for your username and ask you to confirm your SiteKey, an image tied to your account, as well as enter your password. You can find several different checking account options at B of A. Each account connects to the bank's well-reviewed mobile app that helps you manage your banking needs. As a B of A customer, you'll also have access to a large network of physical branches and ATMs.Bank of America earned 3.2 out of 5 stars in Bankrate's overall review of its deposit accounts.

However, it is worth noting that Bank of America has one of the largest suites of banking products in the entire banking industry. In fact, the bank offers a plethora of certificates of deposit , savings accounts, basic, student and business checking accounts, individual retirement accounts and more. This means that no matter your spending or saving needs, there's likely an account available at BoA for you. If you're eager to save big, though, you'll want to look elsewhere. Axos offers five different checking accounts, one savings account, one money market account and CDs with terms that range from three months to five years.

Its mobile app gets 4.7 stars out of 5 on the App Store and 4.4 stars out of 5 on Google Play. Bank of America shines with a stellar online banking experience and digital tools. The website design is straightforward, and information about fees and rates is relatively easy to find. Its mobile app lets you deposit checks, pay bills, send money, monitor activity and account balances and use its virtual assistant, Erica. Android and iOS phone users gave the bank's app high marks.

¹ Transfers require enrollment and must be made from a Bank of America consumer checking or savings account to a domestic bank account or debit card. Recipients have 14 days to register to receive money or the transfer will be canceled. Contact your credit card company to request a direct deposit to your bank account. You may also be able to transfer funds from your credit card to your bank account online by logging into your credit card account. According to Bank of America, it can typically take up to five days to process credit-card-to-bank-account deposits.

If you want to transfer money instantly into your Bank of America account, you can wire the funds. Your bank may offer the option to wire funds online, but in most cases you'll need to visit your local branch. Bring your Bank of America account and routing numbers and request a wire transfer from your account. If you don't have your account number or routing number, you can access them by signing into your online banking account. On the whole, Bank of America and Chase charge similar fees for their accounts. Bank of America has a higher monthly fee for its savings account.

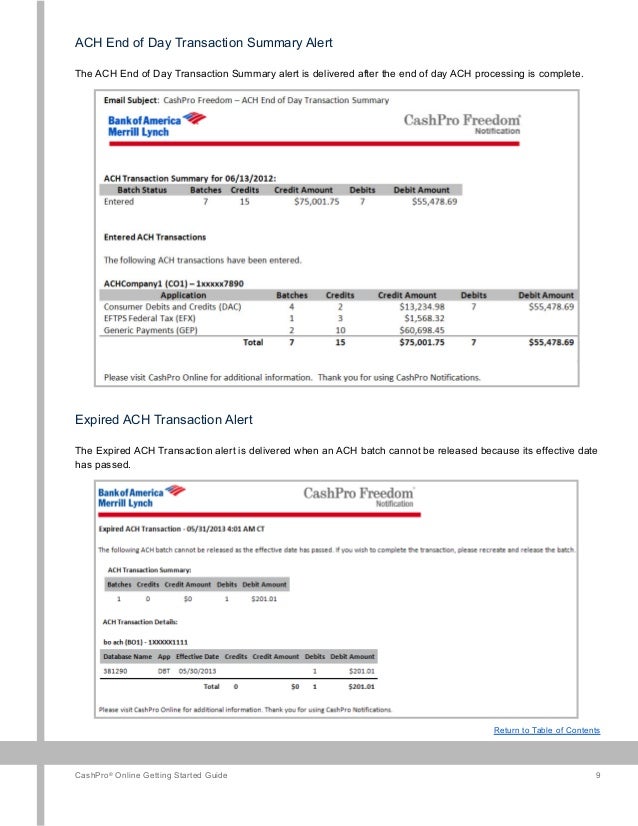

However, most its checking accounts have much lower monthly fees. This is due to Chase's many checking accounts increasing in rewards levels, making the fees more expensive. For example, the Chase Premier Platinum Checking comes with a $35 monthly fee. However, you can have these fees waived by meeting one of the account's requirements. Online bill pay allows you to pay anyone, anywhere, anytime without writing or mailing a single check.